Customers

- Most 1st world mobile payment products are dependent on credit / debit cards.

- Financial inclusion is NOT only about giving people easier access to payment methods or remittance.

2nd Base is exclusively partnered with Wallettec, a technology company focussing on mobile payment solutions and helping you solve any type of traditional and mobile payment integrations.

Patented technology allows for processing of any type of transaction without sharing any payment or personal information. Patent Application No PCT/IB2016/054041

African Agent Count:

We give Fintech companies access to 20 000 agents (and counting).

Mobile Payment and Remittance capability:

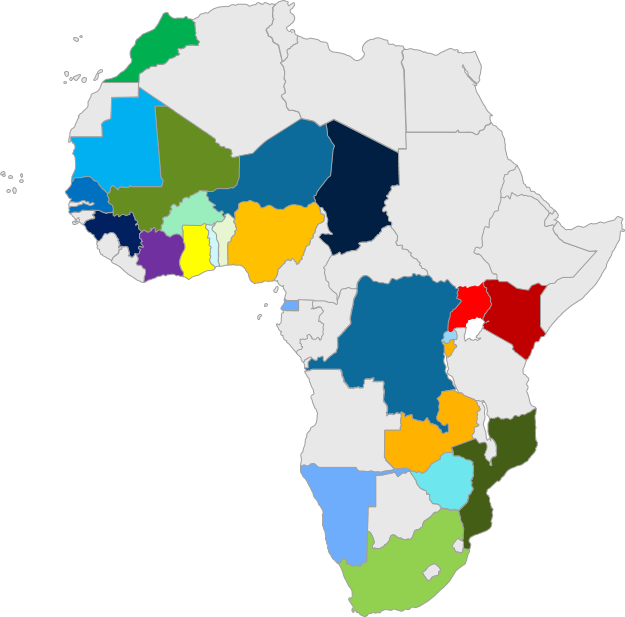

We’re integrated in more than 26 African countries.

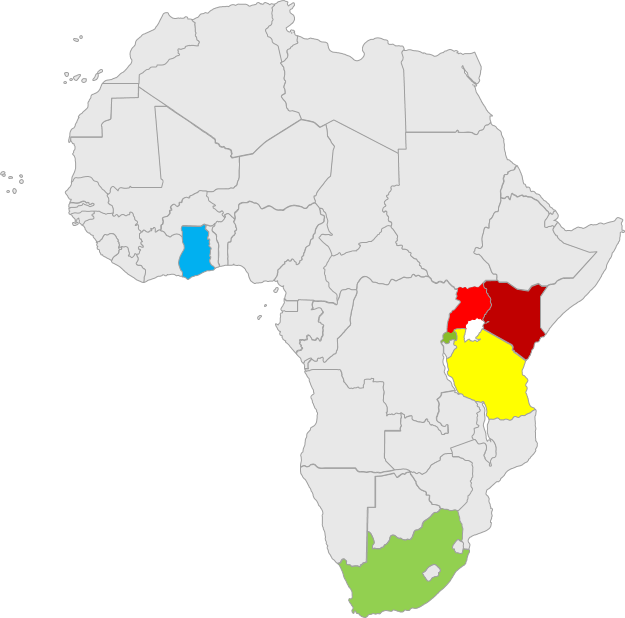

Direct integration agreements with Interswitch give us access to:

Products that make your business easier:

The only way to secure payment information is by not sharing it, EVER

Pay anybody using any mobile money provider no matter on which network they are. It’s always been a problem to pay a friend or family member on a different mobile money network or in a different country. Working with key partners in Africa, Wallettec solved this problem.

A single API & Cloud infrastructure links:

into one seamless multi-currency network assuring secure straight through processing in low to medium value denominated payments.

Our current API is directly integrated in over 20 countries and growing rapidly. Through our partners’ links, we cover the entire globe.